The browser you are using is not supported. Please consider using a modern browser.

Webinar

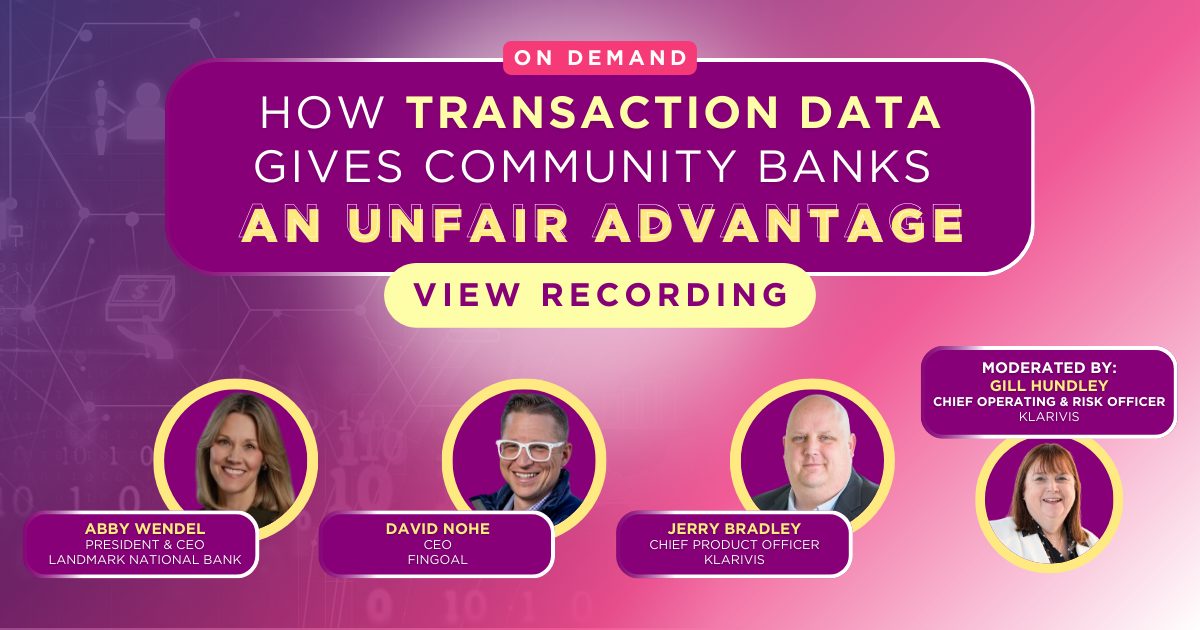

WATCH: How Transaction Data Gives Community Banks an Unfair Advantage

Recorded on February 26, 2025

View Recording:

Life isn’t fair.

All else remaining equal, some community banks will grow faster, increase noninterest income, and have stronger customer relationships – not because they’re inherently “better,” but because they’re smarter about how they use their data.

Every bank has transaction data – but few use it to their advantage. Banks that understand how to leverage their existing transactional data effectively gain an advantage – one that allows them to:

- Expand customer relationships using behavioral insights

- Uncover new sources of noninterest fee income by understanding spending habits

- Optimize channel delivery by knowing where, when, and how customers engage with their bank

Featuring Abby Wendel (Landmark National Bank), David Nohe (FinGoal), Jerry Bradley (KlariVis + former banker), and moderated by Gill Hundley (KlariVis + former banker), this discussion will equip you with actionable strategies to turn your bank’s transaction data into a competitive advantage.

Fair or not, banks that leverage data best will win. Make sure yours is one of them.