The browser you are using is not supported. Please consider using a modern browser.

Features

Bring Your

Data to Life

Take your bank’s business intelligence to the next level with the enterprise banking analytics platform that brings it all together.

How it works.

KlariVis aggregates data from your core and various ancillary systems and enables you to see it more clearly to empower you and your team to work better. As your bank grows, so does the volume of your data. With the time you save on analysis, you can put your new insights towards building a better organization. At KlariVis, we clear the way for you to succeed.

Bank-Wide Benefits

Explore our platform capabilities to see how all layers of your organization can leverage a centralized view of your data to be a better bank for your customers.

Enterprise-Wide Analysis

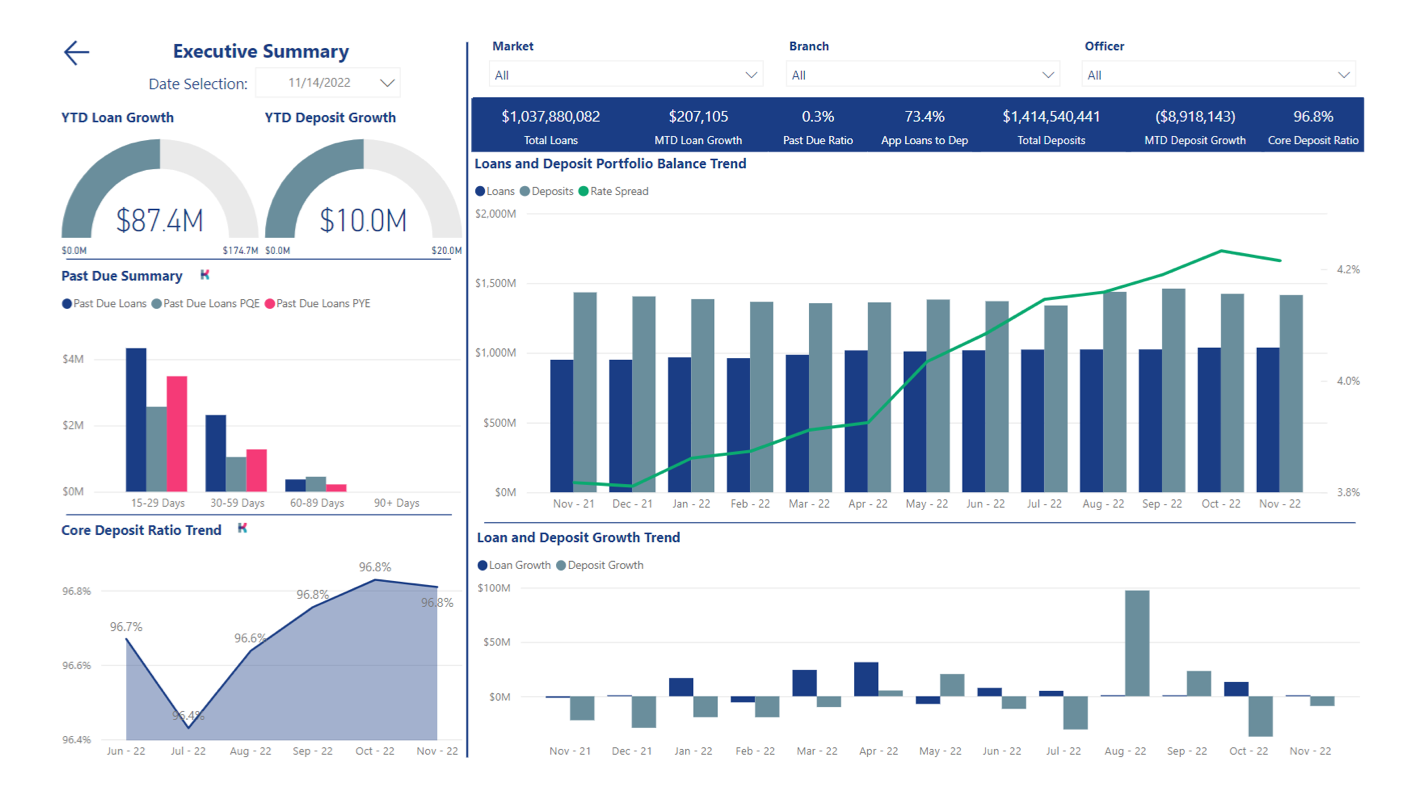

Executive Insights

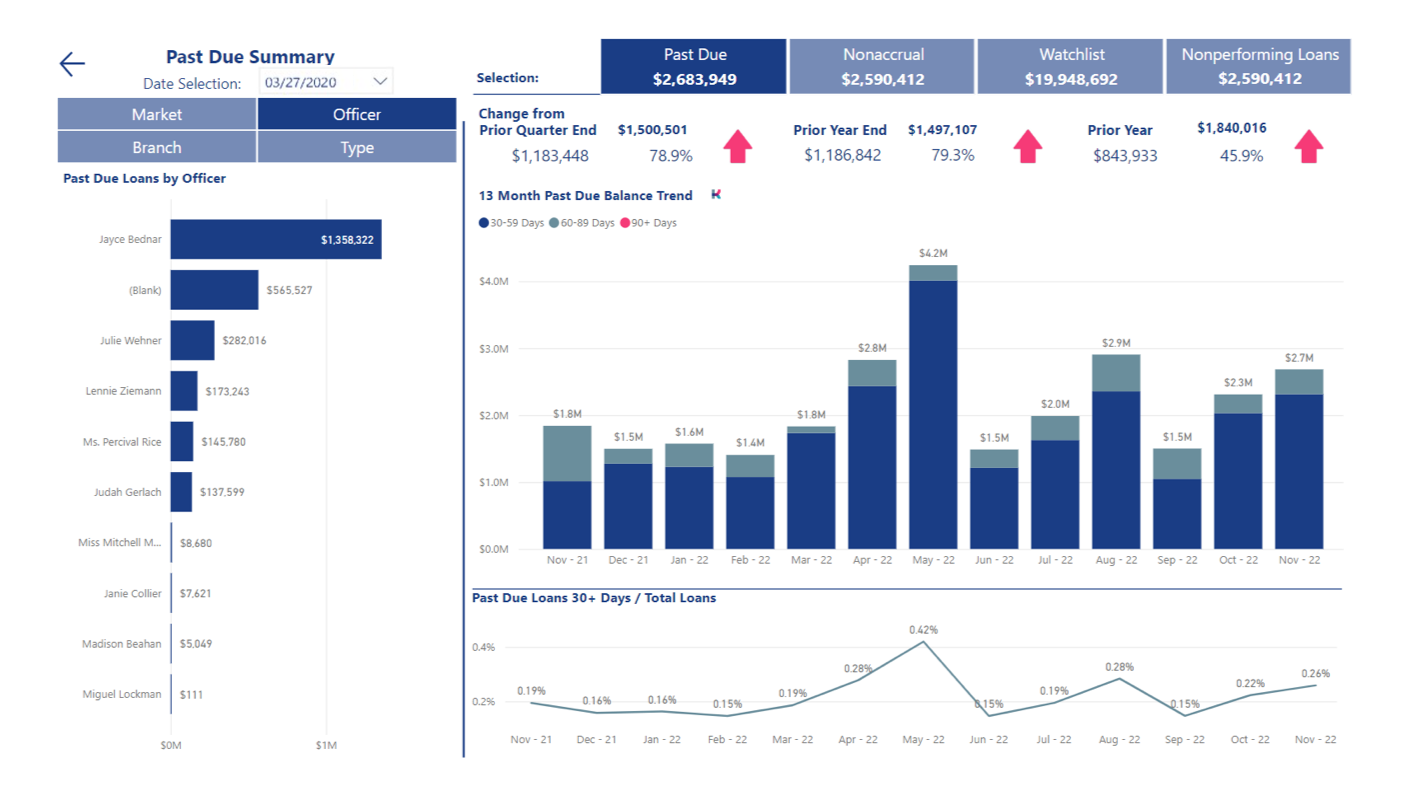

KlariVis provides banking executives with powerfully simple summaries about overall bank performance and growth trends across markets, branches, products, officers and industries.

Schedule a DemoEverything in one place. Leverage your data across all departments.

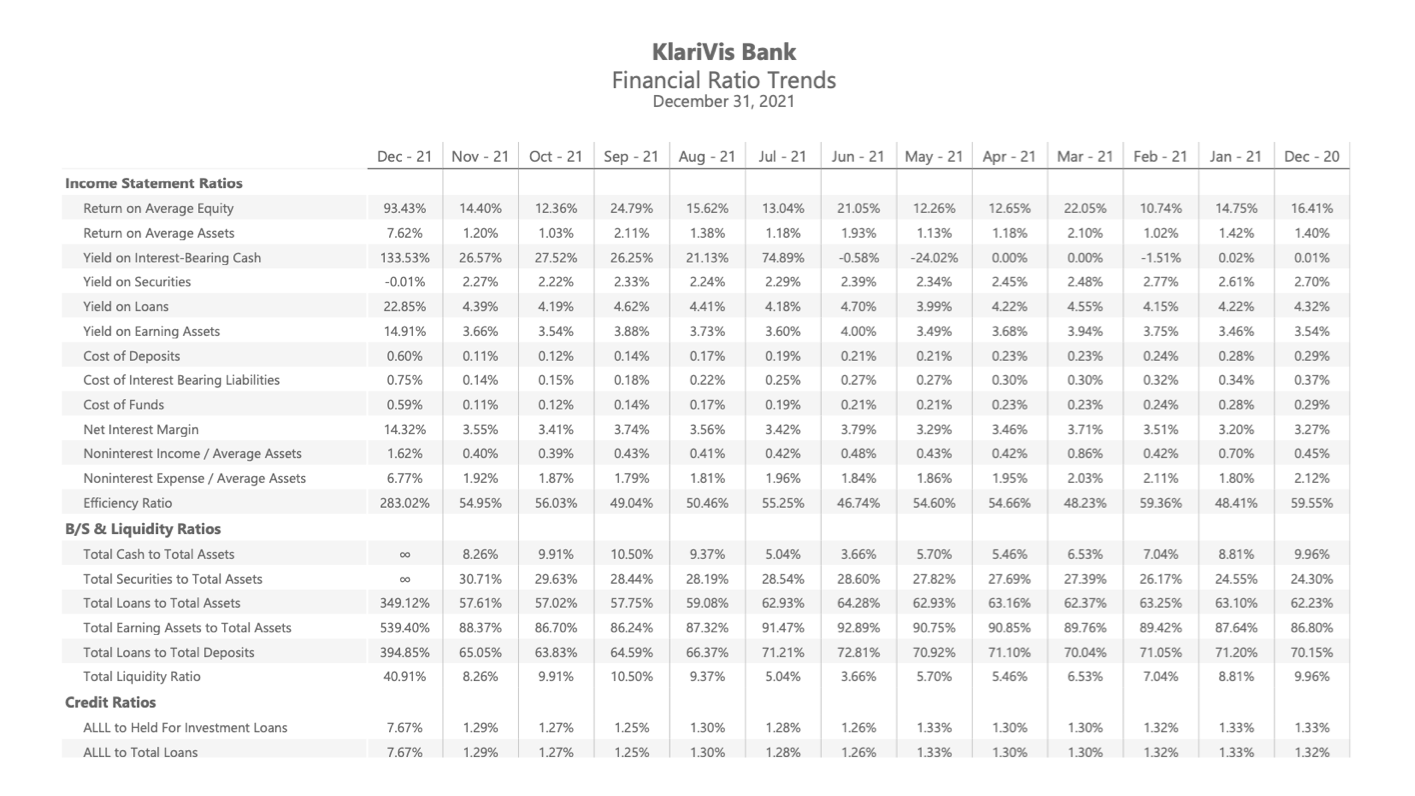

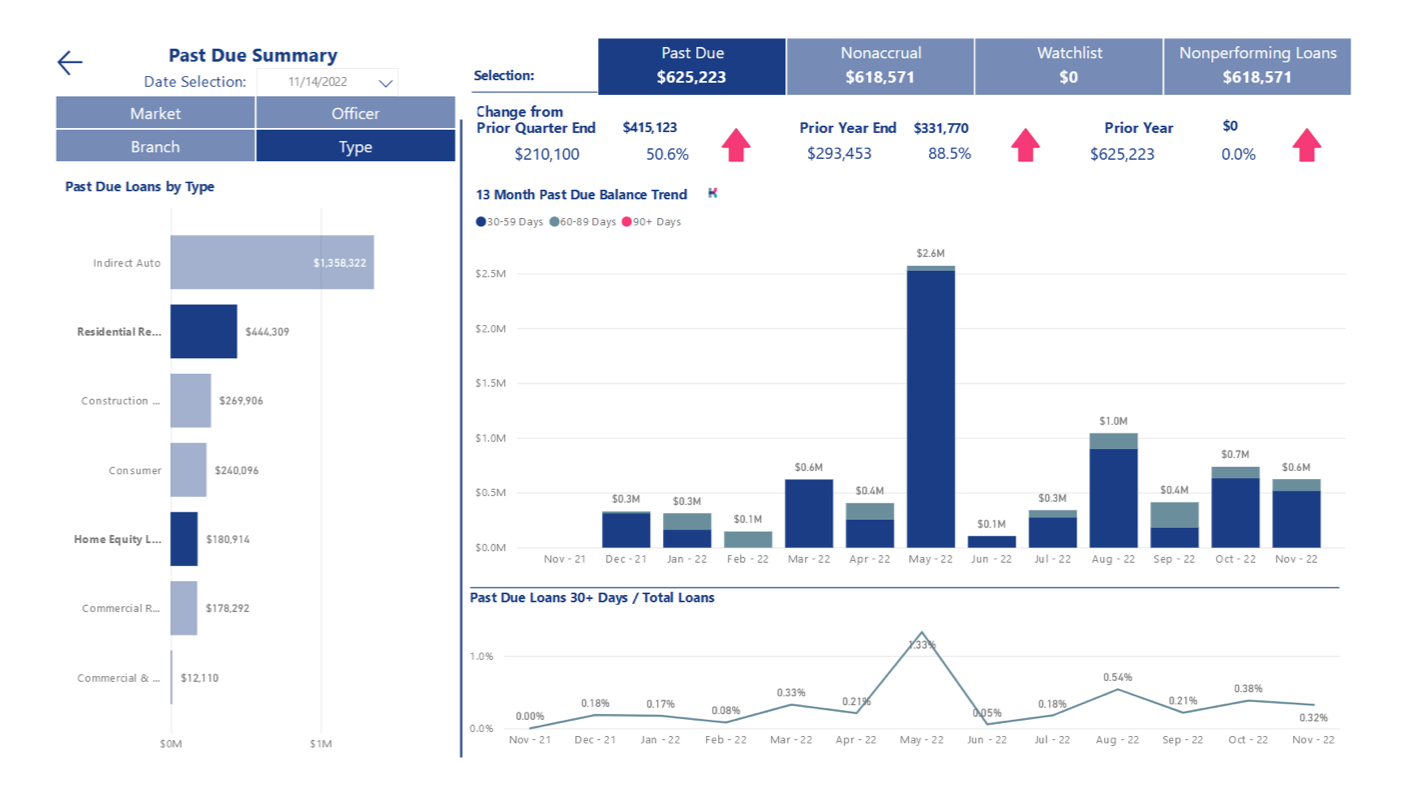

Interactive Dashboards

Ditch static reports, bring your data to life

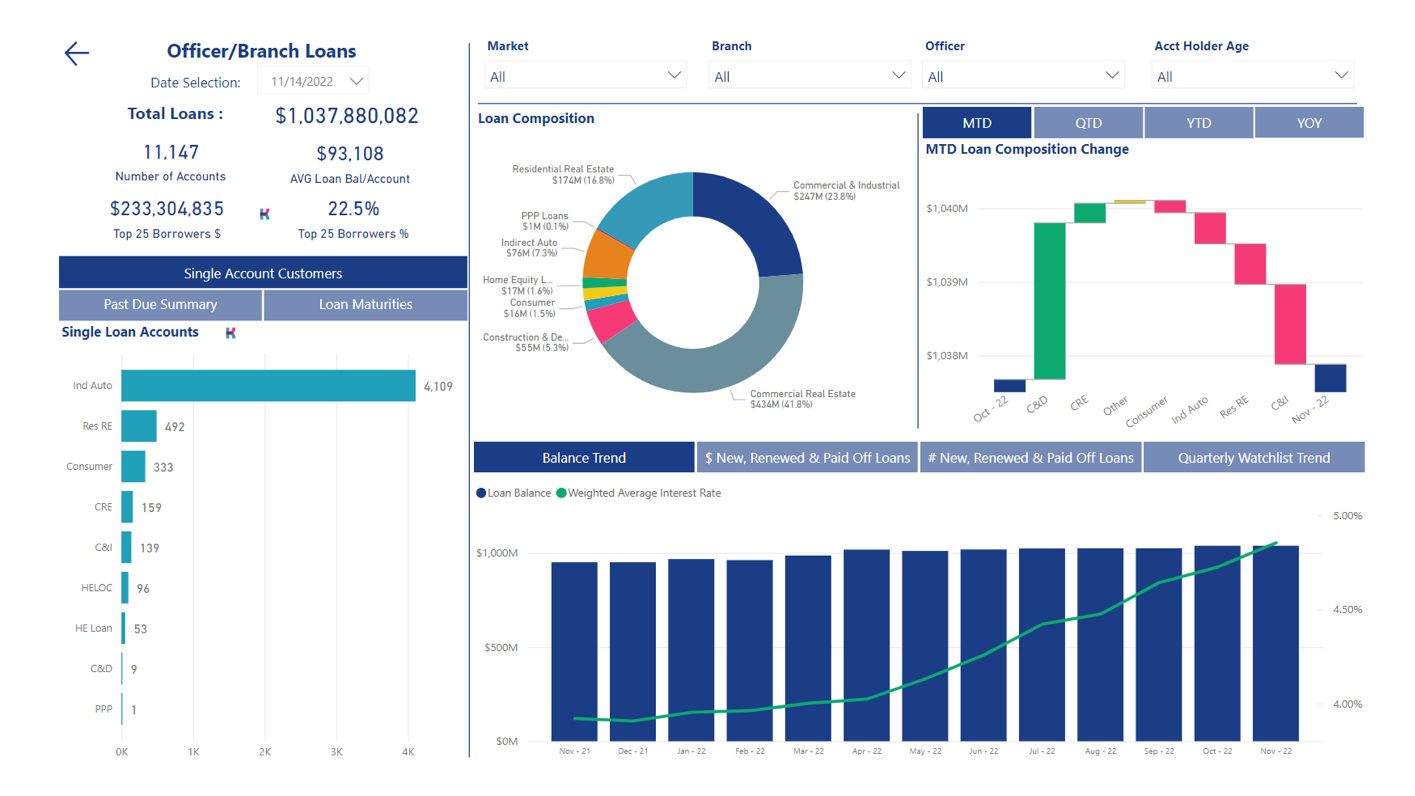

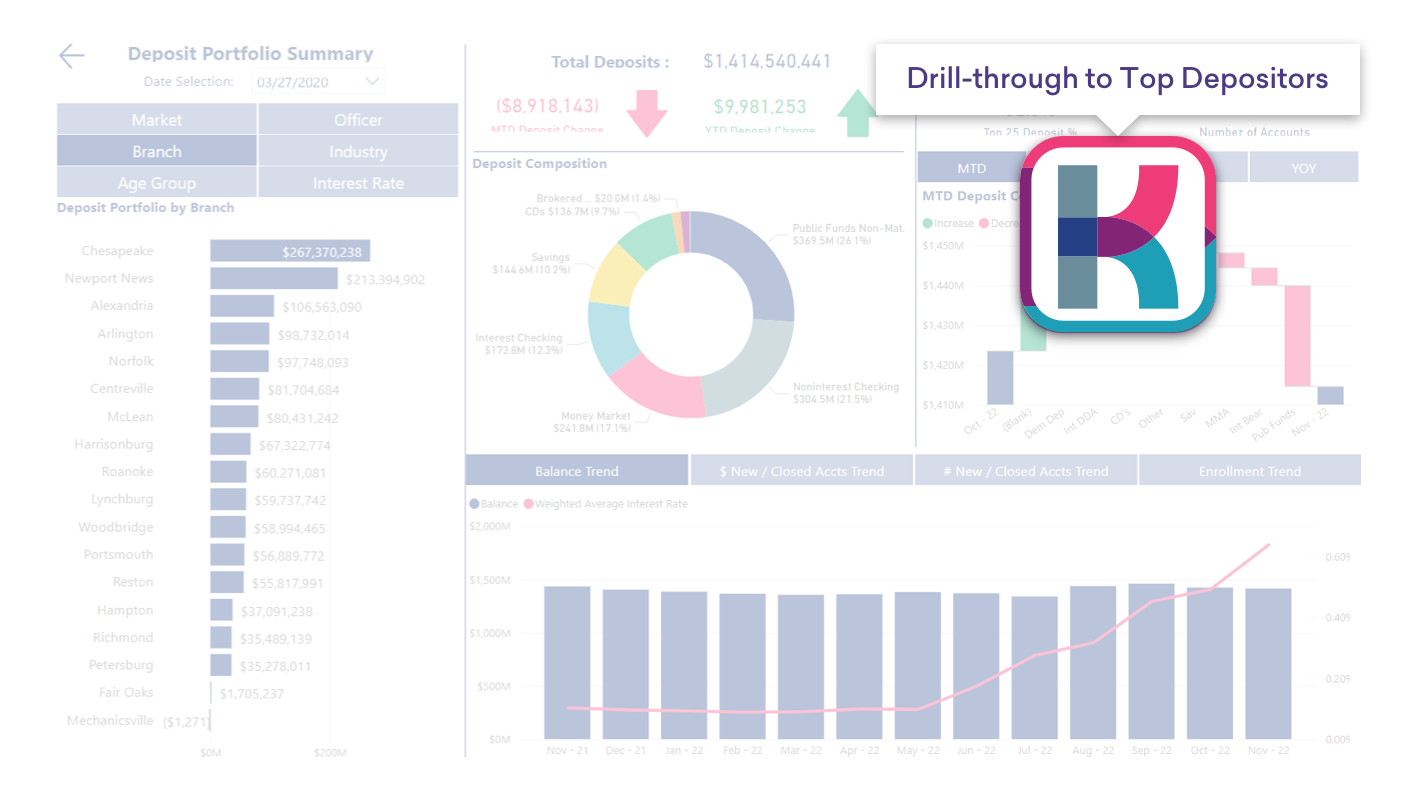

Empower your team to make informed decisions with self-service access to our 650+ interactive and static dashboards. Say goodbye to complicated reporting processes and hello to a more efficient and effective way of working.

Customer-Level Drill Downs

From big picture to transaction level data

Quickly drill down from a macro view all the way to the customer level directly from your interactive dashboard. Instead of sifting through countless reports and making numerous phone calls, spend that valuable time taking action on the data rather than hunting for it.

Enterprise Access

Accurate, centralized data at your fingertips

Gain insights into every aspect of your business, from lending and retail to finance and operations. With enterprise access, you can ensure that everyone in your organization has the data they need to make informed decisions and drive growth.

The KlariVis ecosystem works with all cores and systems.

KlariVis consumes data from any core and ancillary systems you use and turns it into intuitive, interactive data visualizations.

Testimonials

Become a Better Bank.

Stop guessing and start knowing by bringing your data to life.