The browser you are using is not supported. Please consider using a modern browser.

Article

Positioning for Fed Rate Cuts: A Framework for Banking Leadership

Rate cuts aren’t universally good or bad for banks. They’re complicated.

Your net interest margin might compress as loan yields fall faster than deposit costs. Or you might benefit as funding pressures ease and loan demand accelerates. Your asset-sensitive balance sheet could face headwinds, while your deposit-heavy competitor gains advantage. The community bank down the street with a different loan mix and funding structure could thrive in the exact same rate environment that squeezes your margins.

This complexity gets lost in industry discussions that treat all banks as if they respond identically to Fed moves. They don’t. A bank heavy in floating-rate commercial loans faces different pressures than one concentrated in fixed-rate mortgages. An institution flush with low-cost deposits has different opportunities than one relying on wholesale funding.

But there’s another layer of complexity we’re not talking enough about.

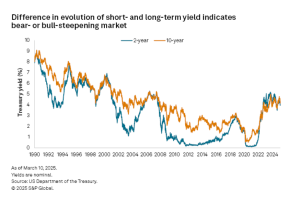

The Fed only controls the shortest end of the yield curve.

The curve has been flat for years, and banks have repositioned their balance sheets accordingly. Now, as short-term rates potentially fall while longer-term yields stay elevated, we could see dramatic curve steepening. Are you prepared for a more traditional sloping curve? And what do you need to do to unwind the positioning bets you’ve made on the curve staying flat?

Having just returned from a banking event (and currently heading to another), I’m hearing this dynamic play out in hallway conversations and lunch buffets.

Wise bankers aren’t making strategic decisions based on industry generalizations; rather, they have a deep understanding of their specific balance sheet dynamics.

Guard Against First-Order Thinking

The most dangerous trap facing boards right now lies in making complex asset-liability decisions based on surface-level metrics and industry groupthink.

Most bankers can recite their “first-order data”: NIM, cost of funds, loan growth rates, return on assets, etc. But strategic positioning requires second-order insights, which are the drivers behind those metrics. You might know your overall cost of funds, but do you know your deposit beta by customer segment? By product type? Can you instantly access which deposit categories will reprice fastest as rates fall, and which customers are most likely to chase higher yields elsewhere?

This deeper data layer is where competitive advantage lives, but it’s also where most institutions fall short. When boards can’t access second-order insights during strategic discussions, they default to industry assumptions and first-order thinking. The result is reactive positioning rather than strategic advantage. The focus is on the rear-view mirror instead of the windshield.

The second-order test: If your asset-liability discussions focus on summary ratios rather than the underlying drivers you can influence, you’re thinking in first-order terms. When directors debate margin compression without knowing which specific loan segments or deposit relationships drive that compression, strategy becomes guesswork.

While industry surveys show that 54% of community banks cite deposit growth as their biggest challenge, your funding dynamics may tell a completely different story when you examine customer behavior by segment. While national data shows commercial real estate loan growth has slowed to an 11-year low, your pipeline analysis by property type and borrower profile may reveal robust opportunities.

The institutions that navigate this environment successfully can instantly access the second-order data that reveals why their metrics behave as they do, then act on those insights during the strategic conversations where decisions get made. For many community banks, platforms like KlariVis make that level of visibility possible.

Rate cuts affect balance sheets differently, and the most prepared institutions model scenarios using their own second-order data rather than relying on stale industry averages. Build decision-ready scenarios for different yield curve shapes: a parallel shift with all rates falling together, a steepening scenario where short rates drop but long rates hold steady, and a flattening scenario where long rates fall faster than expected.

But, remember, scenarios mean little without the granular data that shows how your specific customer segments and product mix respond. For each scenario, you need instant access to deposit repricing patterns by relationship type, loan pipeline data by credit category, and customer behavior analytics that reveal actual rate sensitivity rather than assumed betas.

When your board discusses preparedness, present analysis grounded in the specific drivers of your performance, not industry projections.

Position Your Balance Sheet Strategy

Rate cuts and yield curve changes create risks and opportunities. Institutions with sophisticated data insights can position strategically. The most successful banks anticipate how their specific mix of relationships, products, and market positioning will respond.

If you’ve positioned for a flat yield curve over the past few years, curve steepening could be dramatically positive for margins. But have you maintained the balance sheet flexibility to capitalize? Can you immediately identify which deposit segments offer the stickiest funding? Which loan categories will see the strongest demand? Where can you ride the curve and where are you stuck?

This requires instant access to second-order insights during strategic planning. Know your deposit pricing sensitivity by customer segment, not just overall cost of funds. Track customer retention patterns by relationship depth, not just average account tenure.

Banks that can surface these insights in real-time during management and board discussions make fundamentally different strategic decisions than those relying on quarterly summary reports and industry benchmarks.

My take? The Federal Reserve will likely cut rates, potentially beginning a cycle that reshapes the yield curve many institutions have positioned for. Whether the cut is 25 or 50 basis points matters less than your ability to understand and act on the second-order implications for your specific balance sheet composition.

Preparation means building the analytical depth that lets you and your board distinguish between what’s happening in your market versus what’s happening in the news, then moving confidently based on a sophisticated understanding of your own reality.