The browser you are using is not supported. Please consider using a modern browser.

Every Transaction Tells a Story—Start Listening

Turn transactional data into actionable intelligence with KlariVis. Providing transactional intelligence for banks, KlariVis empowers financial institutions to transform raw data into valuable intelligence that drives smarter decisions and fuels organic growth.

Unlock the Power of Your Data

Why Transactional Insights Matter

Your customers’ transactions hold the key to smarter decisions and organic growth, but only if the data is timely, clear, and easy to use. Providing transactional intelligence for banks means translating thousands of data points into clear, actionable insights. KlariVis makes this possible, empowering your team to uncover opportunities, protect wallet share, and strengthen customer relationships.

Battle Tested, Banker Approved

KlariVis isn’t just another data tool—it’s the only platform designed for bankers by bankers. While competitors might offer data, we intimately understand the frustrations you face turning complex transaction data into actionable insights—and we’re here to make it simple.

Let's Talk TransactionsEnrich Your Data for Clearer Insights

Make Raw Data Make Sense

Your raw transactional data is often unstructured and messy, making it hard to draw actionable insights. With transactional insights for banks, KlariVis transforms this data by:

- Cleansing: Removing inconsistencies, duplicates, and errors to ensure every transaction is reliable and simple to identify.

- Categorizing: Grouping transactions by type—like loans, merchant services, or payment apps—so you can quickly spot trends and opportunities.

- Tagging: Adding contextual intelligence at the user level based on transactional history allows for customer segmentation.

Spot Retention & Growth Opportunities

Uncover Opportunities Before They Leave Your Bank

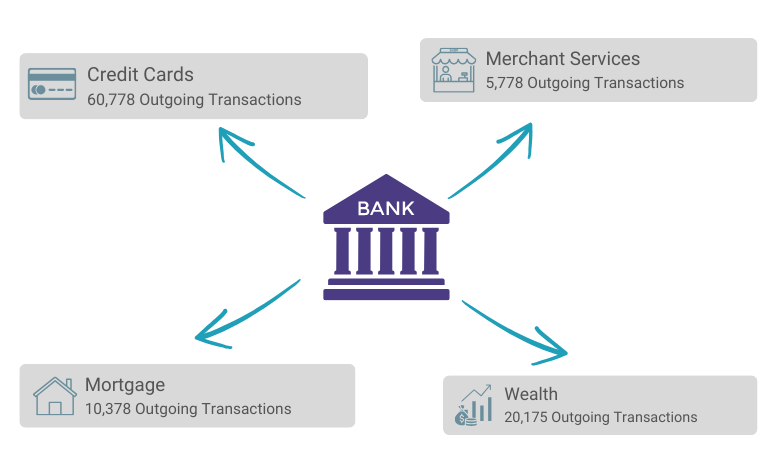

Every outgoing payment—a loan to a competitor or a transfer to an external brokerage—represents an opportunity for banks to retain customers and wallet share.

With the KlariVis Customer Expansion Opportunities Dashboard, you can:

- Proactively address deposit leakage.

- Launch targeted, data-driven campaigns.

- Foster loyalty through personalized, timely outreach.

Optimize Fee Structures and Revenue

Maximize Revenue by Understanding Your Fees

Fee income is a key revenue driver, but without insights, it can be difficult to optimize.

With the Noninterest Fee Income Dashboard you can:

- Track trends in waivers, reimbursements, and revenue gaps across branches and products.

- Gain actionable insights to strategically adjust fee structures.

- Enhance profitability while better serving your customers.

Smarter Service With Data-Driven Decisions

Enhance Customer Engagement Across Channels

Your customers interact with your bank in multiple ways—mobile apps, ATMs, in-branch visits, and through your different product offerings.

With the Channel Delivery Dashboard you can:

- Analyze engagement: Track interactions across channels, products, branches, bankers, and markets to uncover growth opportunities.

- Allocate resources: Optimize staffing, product availability, and channels to boost customer satisfaction.

- Track adoption: Identify popular features and products to refine offerings based on data.

- Detect anomalies: Monitor patterns to quickly address risks and prevent fraud.

Why KlariVis?

Don't take our word for it. Ask them.

Hear from our clients on how KlariVis transforms operations, empowers teams, and offers the responsive support and expertise every bank deserves.

We’ve Earned Our Reputation

See how other banking leaders have benefitted from adding KlariVis to their tech stack.

Testimonials

See Transactional Intelligence in Action

Ready to see how Transactional Intelligence can transform your bank?