The browser you are using is not supported. Please consider using a modern browser.

Clear, centralized data analytics for banking.

See the whole picture and bring your data to life with the industry’s preferred banking analytics platform built for better banking.

Schedule a DemoJust a few of the banks bringing their data to life with KlariVis.

Built for Bankers, by Bankers.

As veteran bank executives, we’ve seen first hand how cumbersome it is to access critical data across disparate systems. KlariVis is changing how banks use data analytics by providing one source to ensure data integrity and empower you with reporting that's consistent, timely and accurate.

Statistics

- ALL Cores & Systems

- Unlimited Users Per Bank

- 650+ Pre-Built Dashboards & Reports

KlariVis Advantage

The future of banking analytics starts here.

We believe that data-driven decision making is the key to success in today’s rapidly changing financial landscape. We’re committed to providing banks with the tools and insights they need to thrive.

Explore the AdvantagesHow we help

Empower strategic decision-making across your entire bank.

- Create a single source of truth across your disparate systems.

- Get insights in minutes, not hours, for more informed and timely decisions.

- Self-service access gives your team the data they need, when they need it.

- Enable your entire team to respond quickly to changing market conditions or customer needs.

- Eliminate errors and inconsistencies to ensure decisions are based on accurate, reliable information.

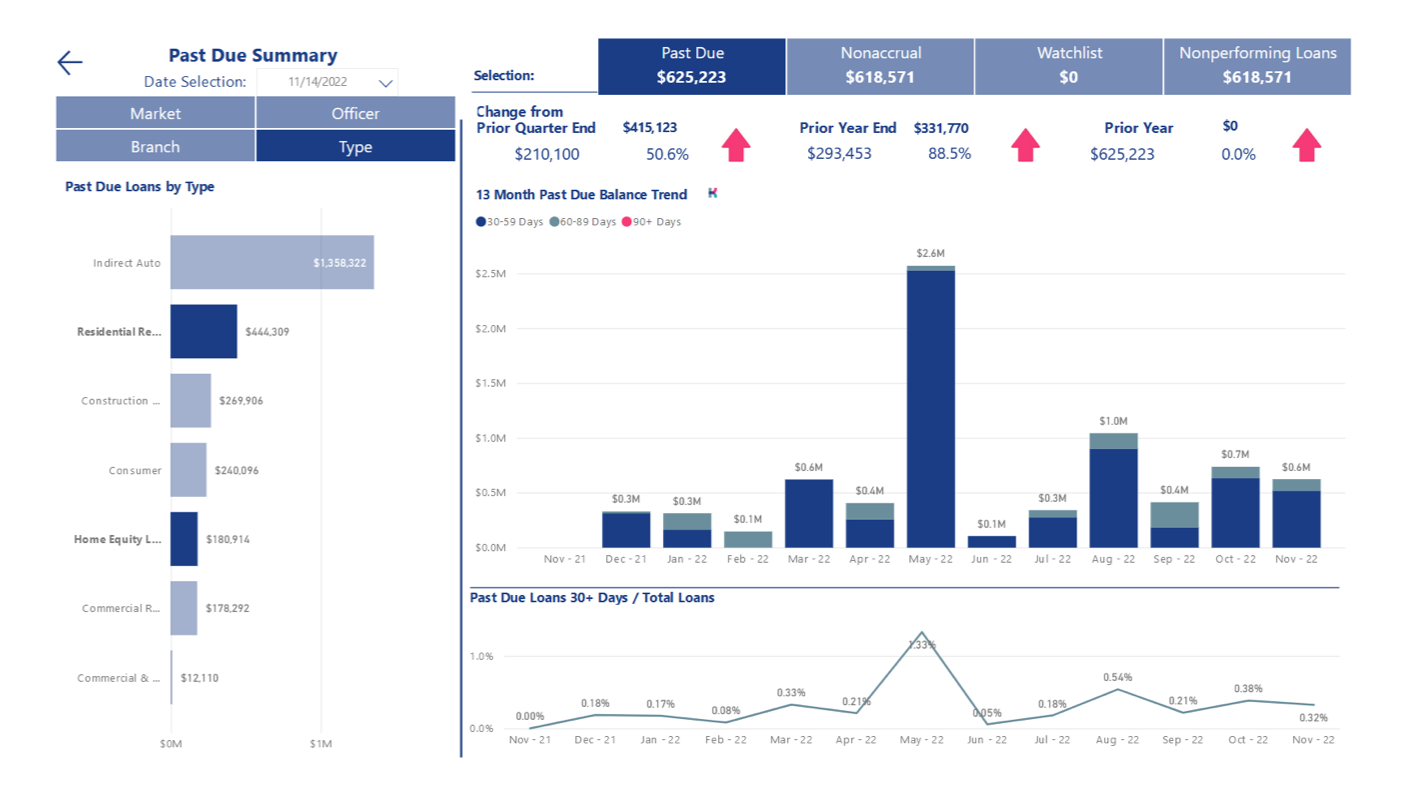

- Better manage credit risk by identifying trends that indicate higher risk.

Tour the Features

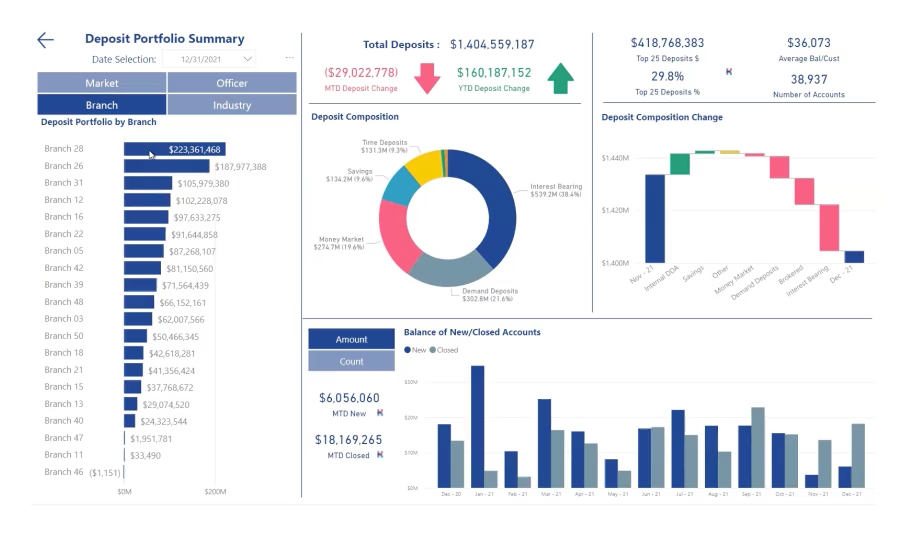

We deliver your data through interactive banking dashboards to give you immediate insight into key performance metrics that empower teams, drive profitability, and improve productivity at every level of the organization.

Interactive Dashboards

Empower your team to make informed decisions with self-service access to our 650+ interactive and static dashboards. Say goodbye to complicated reporting processes and hello to a more efficient and effective way of working.

Explore More Features

Customer-Level Drill Downs

Quickly drill down from a macro view all the way down to the customer level directly from your interactive dashboard. Instead of sifting through countless reports and making numerous phone calls, spend that valuable time taking action on the data rather than hunting for it.

Explore More Features

Enterprise Access

Gain insights into every aspect of your business, from lending and retail to finance and operations. With enterprise access, you can ensure that everyone in your organization has the data they need to make informed decisions and drive growth.

Explore More Features

Testimonials

KlariVis is the premier enterprise banking analytics platform for community banks nationwide.

Expert insights and informative events.

Become a Better Bank.

Stop guessing and start knowing by bringing your data to life.